Divorce is often characterized by an emotionally charged and complex phase. Amidst the personal challenges, navigating financial complexities can feel overwhelming. This is where a Certified Divorce Financial Planner (CDFP) offers essential support. A CDFP employs specialized knowledge and expertise to help you analyze your financial standing, formulate a comprehensive approach, and wisely manage the allocation of assets.

A CDFP will assist you to identify your financial objectives. They will conduct a thorough analysis your income, expenses, assets, and debts to gain a clear picture of your finances. Leveraging this assessment, they will help you create a tailored financial plan that meets your specific needs and requirements.

A CDFP can also offer insightful counsel on diverse financial associated with divorce, such as, such as:

- Financial Assistance

- Establishing Financial Provisions for Children

- Marital Asset Distribution

- Pension Management

- Tax Implications of Divorce

By working of a Certified Divorce Financial Planner, you can navigate the financial complexities during this challenging time.

Securing Your Finances During a Separation

Divorce can be an emotionally difficult time, but it's also crucial to manage the financial implications. Creating a comprehensive divorce here financial plan is essential to protecting your assets and guaranteeing your economic future. This entails carefully assessing your current financial position, recognizing potential obstacles, and crafting a plan that meets your short-term and long-term goals.

A skilled financial consultant can provide invaluable advice throughout this process. They can help you understand your monetary options, discuss fair settlements, and create a plan that enhances your financial stability.

- Reflect upon consulting with an attorney who specializes in divorce law to protect your legal rights.

- Openly communicate with your spouse about financial concerns. This can help to streamline the process and reduce potential conflict.

- Prioritize on building a solid financial structure for your future. This encompasses creating a budget, reducing debt, and saving an emergency fund.

Divorce & Finances: Expert Guidance for a Secure Tomorrow

Navigating the challenges of divorce can be overwhelming, especially when it comes to your finances. Finding expert guidance is crucial during this pivotal time to ensure a secure future. A qualified financial advisor can help you understand your current financial situation, create a comprehensive plan, and preserve your assets.

They can guide you on matters such as splitting property, strategizing retirement savings, and overseeing debt.

Don't delay in reaching out from a financial professional who specializes in divorce. By making proactive steps, you can minimize financial uncertainty and pave the way for a brighter future.

Certified Divorce Financial Analyst : Your Advocate in High-Asset Divorces

Navigating the complexities of a high-asset divorce can be stressful. With significant resources at stake, it's crucial to have a qualified financial expert on your side. This is where a Divorce Financial Specialist comes in. A CDFA has the specialized knowledge and skills to advise you through every step of the divorce process, ensuring your financial future is protected.

They can help you evaluate complex financial situations, formulate a comprehensive divorce settlement, and mitigate the potential for tax liabilities.

Here are some key benefits why seeking a CDFA can be invaluable during a high-asset divorce:

* Expertise in High-Net-Worth Divorces: A CDFA has a deep understanding of the complex financial issues that arise in significant divorces.

* Objective Financial Guidance: They provide unbiased advice based on your individual situation.

* {Protection of Assets**: A CDFA can help you preserve your assets and minimize potential losses.

* Tax Planning Strategies: They can implement tax-efficient strategies to mitigate your tax liability during and after the divorce.

By choosing a CDFA as your advocate, you are committing a proactive step to secure a financially sound outcome in your high-asset divorce.

Tips for Rebuilding Your Future After Divorce

Navigating the financial landscape post-divorce can be challenging. It's common to feel overwhelmed and uncertain about your future. However, by embracing practical financial planning, you can regain control over your standing and build a secure and prosperous future.

Start by creating a comprehensive financial roadmap. Analyze your income, expenses, and possessions. Identify areas where you can cut back and optimize your savings.

Remember to focus on essential requirements like housing, food, and well-being. Don't be afraid to seek professional counsel from a financial advisor or consultant who can provide specific solutions based on your unique needs.

Consider options for debt management. If you have significant loans, explore consolidation strategies to reduce your monthly payments.

Building a resilient financial foundation after divorce is a process that requires dedication. By taking proactive steps, you can strengthen yourself to achieve your monetary goals and create a brighter outlook.

Reducing the Financial Impact of Divorce: A Personalized Approach

Navigating the financial implications of divorce can be a stressful process. Individual divorce is unique, necessitating a tailored approach to minimize damage.

A personalized approach starts by thoroughly evaluating your current financial situation, including assets, liabilities, income and expenditures. Working with experienced professionals such as a monetary advisor and legal professional can provide valuable guidance in formulating a all-encompassing plan to safeguard your future.

By a organized approach and expert help, you can efficiently mitigate the monetary impact of divorce.

Romeo Miller Then & Now!

Romeo Miller Then & Now! Yasmine Bleeth Then & Now!

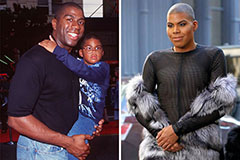

Yasmine Bleeth Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!